I’ve never been more excited to start mowing the grass than I am this spring. It feels good just to get out of the house and do yard work after being stuck at home all winter with limited options for outside activities. In general, I view mowing the grass as a weekly one-hour respite to ‘vegetate’ and do some carefree manual work.

So while I’ve never minded mowing the yard, some might say that I’m not really very good at it. My neighbor’s yard is always meticulously groomed with an angled patchwork design. My yard tends to have wavy lines, spots around the edges where the mower bottoms out, and patches of over-grown grass up against un-edged obstacles that the mower deck can’t reach. Most people who drive by our house don’t look closely enough to notice the imperfections, or maybe they are just too kind to voice any concerns to me.

A far more pressing home ownership issue than my sloppy mowing is the increasing costs of building materi-als. When we insure a home, farm, or business building, we consider reconstruction costs when determining an insurable amount. We always want to make sure we have enough coverage in case of a total loss so that the building can be rebuilt; or at least we want to have a conversation so the client understands the chosen limit. Many home policies include a provision called guaranteed replacement cost, where the insurance company agrees to rebuild your home regardless of cost after a claim. Other policies don’t have this provision, and rebuilding value is limited to the amount shown on the declarations page of the policy.

Building material costs have risen dramatically during the pandemic. A recent Wall Street Journal article stated that last year US manufacturing output posted its largest drop since 1946. Think of all the manufactured products that go into buildings: cement, steel, doors, frames, win-dows, roofing, siding, wallboard, lighting, HVAC, wire, plumbing fixtures, pipes, valves, cabinets, appliances, etc. Not only has the manufacturing output put these items in short supply, increased demand for such materials has created a perfect storm for price spikes. According to the Lumber Composite Price Index, framing lumber has increased 188% in the past 15 months. Instead of having a shortage of toilet paper and hand sanitizer, now we’re running low on appliances and wood.

Since property insurance policies are based on rebuilding costs, you should consider the values that are listed for your buildings and let us know if you have any questions or want us to assist in calculating a current replacement cost.

No worries if we have to work late to respond to inquiries generated by this article. We want to be sure that your property has the right amount of coverage. But the long hours here at the barn might prevent me from getting the grass mowed at home. So if you drive by and it looks extra shaggy, it may be your fault.

Stay well.

Steven L. Faus, CIC, CLU

President

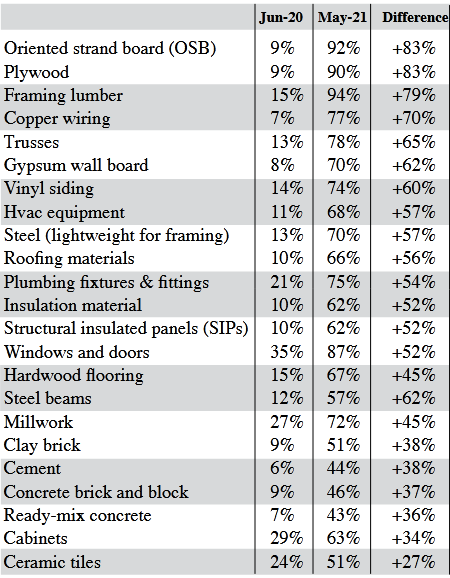

Builders Reporting Shortages (Serious or Some) of Materials: May 2021 vs. June 2020

The National Association of Home Builders (NAHB) reports material shortages are widespread. The number one reported shortage of 2021 by builders is appliances. According to BusinessInsid-er.com, the 2020-2021 winter season was the time to be stuck indoors and remodel the kitchen, which has caused the current delays. The chart on the left, provided by NAHB, shows the percent increase in shortages from 2020 to 2021.

We are excited to welcome Bill Lindemuth to the barn. Bill started in the insurance industry over 40 years ago and brings extensive experience in writing commercial lines insurance. Bill and his wife live in Juniata County, and they enjoy camping trips with grandchildren and hiking in the forests of Central PA.

We are excited to welcome Bill Lindemuth to the barn. Bill started in the insurance industry over 40 years ago and brings extensive experience in writing commercial lines insurance. Bill and his wife live in Juniata County, and they enjoy camping trips with grandchildren and hiking in the forests of Central PA.